Many people believe that investing in your home is never a bad idea. One way in which you can invest in your property is through a home renovation loan. Home renovation loans can either be an important tool for leveraging value-adding projects or provide you the means of getting emergency repairs taken care of. Whatever the case, it is important to know how you can best use a home renovation loan to improve your property.

Ways to Finance Home Renovation Loans

When it comes to securing financing for home improvements, there are several instruments that can help you get the funding you need:

- Home Equity Line of Credit (HELOC) – this is a revolving line of credit (works similar to a credit card) that uses the maximum value of your home’s equity as collateral. You can use this line of credit for anything, from paying for a wedding to financing a truck, but it makes a truly outstanding option for home renovation, as the borrowed funds will be used to add value to your property. As the maximum value of your home will likely be significant, this may be a good financing option if you have an ambitious remodeling project to tackle.

- Home Equity Loan – this loan differs from a HELOC in that it does not revolve each month. However, you should see lower interest rates than with a HELOC. The amount you qualify for in a home equity loan will be based on the difference between your home’s maximum value and the remainder of your mortgage. Essentially, you will qualify for a bigger home equity loan if you have been paying on your house for longer. You can take out all or part of the home equity loan that you qualify for. This may be a good option for renovation projects in which you need a set amount of cash to complete.

- Personal Loan – if your home equity options are not appealing, there is always the possibility of taking out a personal loan to complete your home renovation. While the interest rates will be higher for this product, it can be a good option for smaller projects that you plan on completing and paying for quickly.

Home Renovation Loans are Important for Real Estate Investors

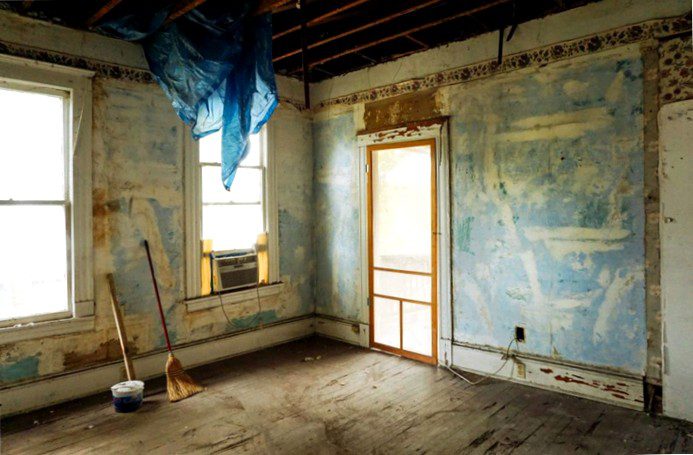

When the goal is to buy a fixer-upper, make a series of upgrades over the course of three to six months, and then sell at a substantial profit, a home renovation loan is not only good–it might be necessary. Using this method, a home renovation loan can be used to finance all of the home improvements and quickly be paid with the capital gains from the house sale.

The following scenario illustrates how real estate investors can use this “house flipping” scenario to make money:

- Get a fixer-upper at a bargain price

- Secure a home renovation loan

- Perform value-adding projects, such as modernizing the kitchen, improving the house siding material, or making the bathroom more functional

- Sell the renovated house at a substantially higher price than which it was purchased, using the capital gains to pay down the home improvement loan

Home Renovation Loans Should be Used to Improve Safety and Livability

Whenever livability and safety are compromised, taking out a home renovation loan is a great way to get the building up to safe living standards. For example, if your dilapidated asphalt roof is leaking heavily, it may be worthwhile to look at hail resistant shingles cost and consider the benefits of taking out a loan. After all, while the cost of the loan is an important factor, subsequent repairs required from continued neglect or health problems arising from substandard living may ultimately be more expensive than the cost of financing.

Another scenario in which taking out a home renovation loan might be a good idea is when the project is relatively minor in cost but can lead to savings. Such a scenario may exist if the doors and windows are turnstiles for exterior air, so the small home renovation loan you take out to install a new window and garage door trim will be paid for through the annual savings in heating and air conditioning costs.

If you want to add value to your home or make an investment in a higher quality of living, a home renovation loan can be a great idea. Home equity lines of credit, home equity loans, and personal loans are some viable products that can help you meet your home renovation needs. While all have their unique appeals, be sure to have a clear understanding of your goals and what the renovation project entails prior to making a decision on how to finance it.

Matt Lee is the owner of the Innovative Building Materials blog and a content writer for the building materials industry. He is focused on helping fellow homeowners, contractors, and architects discover materials and methods of construction that save money, improve energy efficiency, and increase property value.